Orlando, FL – PCE Investment Bankers announces the recent recapitalization of Crane Rental Corp., one of the country’s leading crane rental, hauling and rigging services. The partnership with Hammond, Kennedy, Whitney & Co. Inc. (HKW), a private equity firm, will enable Crane Rental, a family-owned and operated business, to continue to expand and grow in response to increasing demand.

PCE Advises Crane Rental Corp on Major Recapitalization

Topics: Diversified Industrials, Hide Date, crane rental, M&A, recapitalization

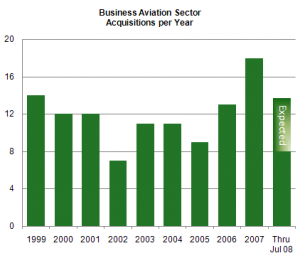

Business Aviation – A Silver Lining in Civil Aviation Clouds?

Business aviation is doing quite well, unlike the air transport sector which struggles with high fuel prices along with many other industries. These good times are driving a wave of business aviation merger and acquisition (M&A) activity that’s producing prices not seen since the dot-com era.

Topics: Aerospace & Defense, Articles, M&A

Success Despite the Economic Slowdown – Which Distributors are Winning and Why

The economic slowdown continues to provide challenges and opportunities to distributors of all descriptions. While a limited group of distributors have proved to be immune to the current downturn, by and large most participants within the marketplace are affected by an uneasy environment. With no signs of the weakness abating, it is critical to consider all options available to most successfully maintain and/or add value during these turbulent times.

Topics: Articles, Diversified Industrials, Hide Date, M&A

We are apparently heading ‘Back to the Future’ based on the first quarter M&A transaction results of 2008. While merger and acquisition activity is down in both value and volume over the last twelve months, when compared to 2004 the activity remains quite respectable. However, the trend over the last four quarters would indicate that we could see a further drop in M&A activity. The general consensus is that we are either in or headed into a recession (data released this week indicates a modest 0.6% growth rate for 1st quarter 2008). The sub prime mortgage contagion continues to spread; foreclosures are up; banks are scrambling for new capital; access to loans is restricted; all of this is forcing nearly everyone to pause.

Maintenance Repair and Overhaul: Clear Skies for Middle Market M&A

Florida is home to the largest number of independent maintenance, repair and overhaul (MRO) companies in the United States. While mega-deals such as Dubai Aerospace Enterprises’ acquisitions of SR Technics, Standard Aero and Landmark Aviation garner press attention, smaller MRO companies are being acquired at record levels with scarce media attention. In this issue we take a closer look at this interesting segment.

Topics: Aerospace & Defense, Articles, Hide Date, M&A

The Economic Slowdown and Credit Crunch: What This Means for Distributors

During the recent National Association of Wholesale Distributors Annual Executive Summit in Washington, D.C., I was fortunate enough to hear the outlooks given by economists Alan Beaulieu and Steve Moore. Unfortunately, their economic outlooks were not particularly positive in nature. These presentations seemed to set the tone for the rest of the summit. Most conversations I had with distribution business owners surrounded the softening economy and the status of the M&A environment relating to the economic slowdown and stressed capital markets.

Topics: Articles, Transportation & Logistics, Diversified Industrials, Hide Date, M&A

Florida Home Building – Price and Volume Equilibrium

Volume and price are inversely related – the flip sides of one coin. Classically, the lower the price, the higher the volume and vice versa. Florida homebuilding turned this relationship on its head with accelerating prices and volumes from 2001-2005 before collapsing volumes and declining prices ever since.

Topics: Articles, Hide Date, Building Products & Construction, M&A

The mergers and acquisitions markets were forced to step back and evaluate where they stood following the credit crisis in the second half of 2007. After some introspection, it appears that the market for middle market companies (value < $250 million) remains vibrant. While larger transactions (value > $250 million) suffered due to deteriorating credit markets and company performance (i.e. SLM Corp., United Rentals, Harman International, Acxiom), strategic and financial acquirers still exhibit strong appetites for quality assets. Buyers are on the lookout for companies with good product/service mixes that fill a market need and provide strong cash flow. Financial acquirers flush with cash and strategic buyers with strong balance sheets continue to seek desirable opportunities. While there has been some impact on valuations and debt levels, particularly multiples for acquisitions under $50 million, transaction levels and pricing remain lively. In addition, fears of a recession as well as the recent market correction will affect mergers and acquisitions activity, but will be partially offset by the resulting lower interest rates. Together these factors project an active market for mergers and acquisitions in 2008, although off previous highs.

Modeling, Simulation & Training: Middle Market M&A Activity in 2008 and Beyond

In the 25 June 2007 issue of the PCE Aerospace & Defense Newsletter, we presented a bullish 12-18 month outlook on the modeling, simulation & training (MS&T) sector, and per our predictions, deal activity and prices obtained by sellers have remained high. MS&T owners have continued to receive a median 1.8x sales price when selling their companies.

Topics: Aerospace & Defense, Articles, Hide Date, M&A

Considering a Liquidity Event? Value Drivers for Distribution Businesses

Ongoing M&A activity within the wholesale distribution industry has an increasing number of owner’s contemplating the sale of their business. Those who properly prepare and consider the criteria buyers use for an acquisition consistently achieve more favorable outcomes.

Topics: Articles, Diversified Industrials, Hide Date, M&A

Meld je hier aan!

Recente berichten

Berichten geordend op tag

- Hide Date (199)

- Articles (175)

- M&A (101)

- Valuation (55)

- News (42)

- ESOP (29)

- Events (23)

- healthcare (17)

- Diversified Industrials (14)

- Building Products & Construction (13)

- Power & Energy (13)

- Banking, Finance & Insurance (12)

- Industry Reports (12)

- Advisory (10)

- Aerospace & Defense (9)

- E-books (7)

- IT & Telecom (6)

- Transportation & Logistics (5)

- Private Equity (4)

- PE (3)

- Uncategorized (3)

- Business Services (2)

- Case Studies (2)

- business owner (2)

- due diligence (2)

- Consumer & Food (1)

- ESOP Valuations (1)

- Tri-City Electrical (1)

- acquisition (1)

- acquisitions (1)

- category/test (1)

- construction (1)

- crane rental (1)

- cybersecurity (1)

- international (1)

- recapitalization (1)

- representations and warranties (1)

- reps and warrants (1)

- strategy (1)

- valuation gap (1)

MAFSI IS… Everywhere food is. And everywhere you are.

275 rep agencies, 260 manufacturers and 2,400 members strong. Spanning North America, feeding 300 million people and changing an industry.

Contact Us

Atlanta, GA 30307