Late last year Congress passed the final version of the Tax Cuts and Jobs Act of 2017. Although the plan does not alter ESOP legislation, there are some indirect effects on ESOPs. Some of the changes will impact the valuations of ESOP-owned companies.

Topics: Articles, Valuation, ESOP, ESOP Valuations

Exploring Your Exit Options: A Dual Track Process

In this favorable market, how do sellers contemplating an exit from their business decide whether to pursue an M&A sell-side transaction or the formation of an Employee Stock Ownership Plan (ESOP)? They don’t. Instead, they run a dual track process which provides knowledge of possible outcomes simultaneously. This allows the seller to make the best choice for his/her situation based on actual offers and company specific options.

A New Day, A New Way: Goodwill Impairment Testing

The measurement of goodwill and subsequent tests for impairment under purchase accounting rules is complicated and sometimes a source of controversy between companies and their auditors and advisors. Fortunately, the Financial Accounting Standards Board (FASB) has come to understand that the cost of the rigorous analysis required does not meet the cost/benefit constraint that lies at the heart of accounting rules. Earlier this year FASB issued revised guidance for goodwill impairment testing designed to make the entire process more straightforward and economical.

On their face Employee Stock Ownership Plans (ESOPs) appear to be a vehicle for employee ownership and not something that invites Private Equity Group (PEG) investment due to differing ownership structures. On the contrary, ESOPs and PEGs can co-exist in a mutually beneficial relationship. In many cases, PEGs view ESOP companies as having the exact characteristics they look for in target investments.

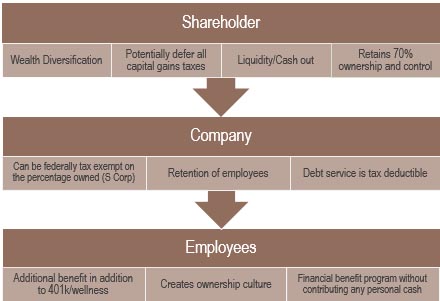

Partial ESOP Sale: The Triple Threat Liquidity Strategy

As privately held businesses mature and grow in value, the desire for, and prudence of, personal liquidity and diversification grows in importance to business owners. When much of one’s personal net worth is tied to a highly successful, yet illiquid business, the owners are often faced with the question “how can I personally diversify yet remain in control of my company”? The use of an Employee Stock Ownership Plan, or “ESOP”, provides business owners a distinct advantage toward personal liquidity. An ESOP allows the business owner to cash out a portion of his/her business, retain control, while providing excellent tax benefits to both the shareholder and the company going forward. Furthermore, the benefits an ESOP provides to the company and its employees are significant, which makes the ESOP a triple threat liquidity strategy.

WINTER PARK, FL – PCE Investment Bankers, Inc., a leading financial services firm for mid-market companies, is pleased to announce that the shareholders of Tri-City Electrical Contractors, Inc. (Tri-City) have transferred an interest in the company to the Tri-City Employee Stock Ownership Plan (ESOP) Trust.

Topics: ESOP, News, Tri-City Electrical

Join PCE for NCEO’s two-day ESOP Symposium specifically designed to address issues facing established ESOPs. The ESOP Symposium is a gathering of the countries leading ESOP experts providing the most up to date information about ESOPs. Presentations will cover best practices related to governance, financing, operations, repurchase obligation, and culture. You will also have an opportunity to network with other ESOP companies. Additional details, agenda and registration information can be viewed here.

Daily, the sale or merger of a company involved in a service industry grabs the headlines. Whether a service provider to the healthcare, insurance or other industry, it feels like all companies and industries are in “play”. The announcements of these sales or mergers are normally accompanied with assurances from management that the ownership change will not adversely affect employees or the level of service to customers. Regardless how strong the promise, the fear associated with change is unsettling for many. So while the pace of mergers and acquisitions (M&A) continues to increase, business owners in all industries must continue to keep a watchful eye and consider all options for succession of ownership, both external and internal. One interesting option, which we’ll discuss further, may be the sale to an Employee Stock Ownership Plan (ESOP).

Topics: Articles, ESOP, healthcare

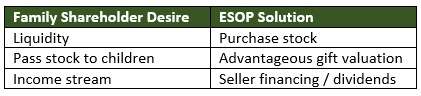

ESOPs – Keeping Family Businesses in the “Family”

Family-owned businesses, a key pillar in the American economy, make up a significant number of the privately held companies across our country. Although these companies cut across all industries and range in size from small to large, they all share common challenges. The most daunting of these challenges is how to manage the transition of the business from generation to generation. Keeping the core family values balanced with an ever-changing market place and often diverging goals amongst the family members is a challenge that many family businesses don’t survive. One intriguing solution to this challenge for many family-owned businesses is to bring the employees into the shareholder group through the sale of stock to an Employee Stock Ownership Plan (ESOP).

The flexibility available in the sale of a business to an Employee Stock Ownership Plan (ESOP) is often the reason that business owners choose this tax-advantaged liquidity strategy. Considering a sale to an ESOP is often, but not always, the answer to our clients’ liquidity questions. The list below contains many of the questions where “consider a sale to an ESOP” is the answer.

Meld je hier aan!

Recente berichten

Berichten geordend op tag

- Hide Date (199)

- Articles (175)

- M&A (101)

- Valuation (55)

- News (42)

- ESOP (29)

- Events (23)

- healthcare (17)

- Diversified Industrials (14)

- Building Products & Construction (13)

- Power & Energy (13)

- Banking, Finance & Insurance (12)

- Industry Reports (12)

- Advisory (10)

- Aerospace & Defense (9)

- E-books (7)

- IT & Telecom (6)

- Transportation & Logistics (5)

- Private Equity (4)

- PE (3)

- Uncategorized (3)

- Business Services (2)

- Case Studies (2)

- business owner (2)

- due diligence (2)

- Consumer & Food (1)

- ESOP Valuations (1)

- Tri-City Electrical (1)

- acquisition (1)

- acquisitions (1)

- category/test (1)

- construction (1)

- crane rental (1)

- cybersecurity (1)

- international (1)

- recapitalization (1)

- representations and warranties (1)

- reps and warrants (1)

- strategy (1)

- valuation gap (1)

MAFSI IS… Everywhere food is. And everywhere you are.

275 rep agencies, 260 manufacturers and 2,400 members strong. Spanning North America, feeding 300 million people and changing an industry.

Contact Us

Atlanta, GA 30307