Today is one of the most interesting times in recent history to be the owner of a privately-held business as these owners find themselves experiencing a rebound in the domestic economy but facing an uncertain tax environment. The question that many business owners are asking themselves is do we monetize some or all of our company today and capture the increased value of the business and lower tax rates or do we stay invested and realize further value appreciation but risk a higher tax environment. While the path becomes clear for many business owners, many remain in a quandary. The answer for these individuals may lie somewhere in the middle where they can monetize some of their investment in the current low tax rate environment, keep significant ownership for future appreciation and reduce their corporate and individual tax profiles. These are all achievable goals by executing a sale of a portion of their company to an Employee Stock Ownership Plan (ESOP).

Implementing an Employee Stock Ownership Plan (ESOP) as part of a diversification or exit strategy for business owners fell out of favor in recent years as the credit crisis reduced liquidity options. All evidence, including recent transaction activity, indicates liquidity has returned to the ESOP market. This development, coupled with several research studies completed by various academic and non-profit research institutes, makes the sale to an ESOP a compelling strategy for today’s business owners who want to participate in the future growth of their business while diversifying personal assets.

ESOP Owned Companies: The Valentine’s Day Edition

It’s Valentine’s Day, love is in the air and ESOP owned companies have suitors lining up at their doors in the form of banks and other capital providers attempting to woo them. The fact that ESOP owned companies outperformed their competitors during the most recent recession is only one of the reasons that ESOP owned companies are finding an array of capital providers eager to finance their growth plans, acquisitions or ESOP stock purchases. ESOP owned companies are better borrowers due to their tax benefits as well as the continuity of the employee base and management team. As this becomes more widely known, it is a great time for ESOP owned companies to explore their options for financing and to be sure that they are aligning themselves with the best partners as they continue to grow and transition ownership.

Bipartisanship at Work – ESOP Legislation Supported by Both Sides of the Aisle

While recently attending the Employee-Owned S Corporation of America (ESCA) Federal Policy Conference in Washington DC, I was struck by the fact that both Democrat and Republican congressional leaders who spoke at the conference were in support of current legislation that expands the idea of broad based employee ownership in privately held companies. A quick review of the conference material confirmed that Senators and Congressman, Republicans and Democrats in attendance championed the idea of employee ownership, and supported the idea that the current legislation promoting Employee Stock Ownership Plans (ESOPs) needed to be preserved and expanded. Who knew ESOPs would be the issue where the two parties could find common ground, but ESOPs are an ownership transition strategy that works in both concept and practice for both owners and employees. This bipartisan support of ESOPs has led to broad based support for two new pieces of legislation currently in front of the House of Representatives (HB 1244) and in front of the Senate (SB 1512), both of which would enable more business owners and companies to take advantage of the ESOP option when evaluating liquidity options for their privately held stock. As a sign of the bipartisan nature of these pieces of legislation, 41 congressman co-sponsored HB 1244 of which 22 are Republican and 19 are Democrats.1ESOP legislation was originally crafted in 1974 as a partial response to concerns over shortfalls in social security. With the exception of a major revision in 1996, the legislation has largely remained intact. Why are ESOPs getting more attention now? Because our elected leaders are all focusing on growing small businesses, expanding jobs and ensuring Americans are provided for in their retirement years. ESOPs address all of those initiatives, and are a concept that works and deserves to be expanded. The evidence shows that ESOP-owned companies have several characteristics that benefit the general economy, including:

Want Liquidity? Consider Selling a Piece of Your Company to an ESOP

While the M&A market continues to recover, business owners are utilizing Employee Stock Ownership Plans (“ESOPs”) to satisfy the need to convert some of their illiquid privately held company stock into cash and other liquid investments. The ESOP is attractive due to significant tax savings to the owner and company, flexible deal structures and speed with which a transaction can be completed. With higher capital gains taxes looming in 2011, now is a great time to evaluate this liquidity strategy.

Over the past twelve to eighteen months, we have heard considerable discussion about how the economic downturn has affected valuations of private companies. All of us who have 401ks understand the volatility of public company valuations. Private company values have been affected similarly. However, some valuation professionals have instituted the “smoothing” method to lessen the market volatility on business valuations.

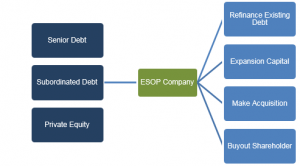

Restructuring the Balance Sheet of an ESOP Owned Company

This year is expected to be full of opportunity for many privately held companies, including those owned by Employee Stock Ownership Plans (ESOPs). An essential component for companies to take advantage of these opportunities is a proper capital structure.

The recent M&A market has been defined by many different types of buyers, but the most publicized has been the consolidators. The consolidation of the financial industry has dominated the headlines, only rivaled in press coverage by the reorganization of the auto industry. Step away from the public markets and the headlines and you see similar behavior taking place amongst privately-held companies. Whether a company is unable to survive in this economy or an owner wants to relieve some management responsibility, many business owners are seeking to sell their company or merge with strong partners. Due to the significant tax advantages that are provided to companies that have Employee Stock Ownership Plans (ESOPs), they often fill this position of strong partner and end up as consolidators.

Seller Financed ESOPs: Certainty to Close at an Attractive Value

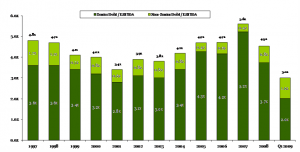

The challenges that many of the country’s banks are experiencing are very well publicized and are affecting financing for companies of all sizes and across all industries. Some companies that were once coveted credits of the banking industry are now having trouble renewing senior facilities or are having them renewed under more onerous terms in spite of continued performance. Banks have also pulled back on the amount of financing they are extending to buyers of companies that want to rely on financing to support the purchase (exhibit 1). This has had several effects on the M&A market; lower transaction multiples, more reliance on equity as capital for the acquisition and higher return expectations on investments.

The Sale to an ESOP Provides a Creative Alternative

During these unprecedented economic times, the use of an ESOP can provide business owners a unique path to liquidity and increase the cash flow of the business. The goal of liquidity is a challenge in today’s market due to stricter underwriting standards by lenders and buyers cautiously approaching acquisitions.

Meld je hier aan!

Recente berichten

Berichten geordend op tag

- Hide Date (199)

- Articles (175)

- M&A (101)

- Valuation (55)

- News (42)

- ESOP (29)

- Events (23)

- healthcare (17)

- Diversified Industrials (14)

- Building Products & Construction (13)

- Power & Energy (13)

- Banking, Finance & Insurance (12)

- Industry Reports (12)

- Advisory (10)

- Aerospace & Defense (9)

- E-books (7)

- IT & Telecom (6)

- Transportation & Logistics (5)

- Private Equity (4)

- PE (3)

- Uncategorized (3)

- Business Services (2)

- Case Studies (2)

- business owner (2)

- due diligence (2)

- Consumer & Food (1)

- ESOP Valuations (1)

- Tri-City Electrical (1)

- acquisition (1)

- acquisitions (1)

- category/test (1)

- construction (1)

- crane rental (1)

- cybersecurity (1)

- international (1)

- recapitalization (1)

- representations and warranties (1)

- reps and warrants (1)

- strategy (1)

- valuation gap (1)

MAFSI IS… Everywhere food is. And everywhere you are.

275 rep agencies, 260 manufacturers and 2,400 members strong. Spanning North America, feeding 300 million people and changing an industry.

Contact Us

Atlanta, GA 30307