As an investment banker who works with Employee Stock Ownership Plans (ESOPs), I was surprised when The New York Times recently published an article quite critical of ESOPs. The Times seems to suggest that US Sugar workers were “cheated out of money that was rightfully theirs” because of an ESOP.

Many owners of closely held businesses realize Employee Stock Ownership Plans (ESOPs) effectively meet their liquidity and business succession needs. Through this process, they discover that ESOPs also have tremendous value as an estate planning tool, an often overlooked benefit. The benefits come in the form of reduction of estate taxes, gifting plans, accurate valuation and liquidity options.

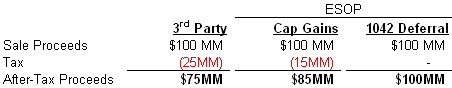

An ESOP (Employee Stock Ownership Plan) is an attractive way to access the personal wealth currently trapped in the shares of Florida’s privately owned businesses and share the wealth with the employees that helped create that business.

One of the toughest questions a business owner will ultimately face is when to sell the company. But once that decision is made, a host of other questions arise: How do I ensure I get the best value for my company? Do I want to walk away completely or retain some ownership and How long do I need to stay on after the sale to ensure the transition goes smoothly? And what about my employees, how do I make sure their loyalty and support is rewarded and their future secure? And that dreaded of all questions, how do I minimize the tax bite?

When Emotional Capital Is Your Greatest Investment: Consider the ESOP

Often business owners who are interested in bringing liquidity to their holdings seek only a sale to disinterested third parties. And that frequently works out just fine for both the buyer and seller. But sometimes the personal emotional strings attached to the business, whether on the surface or not, are simply too strong to break the ties and turn control over to “the new guys on the block.” You may have heard the term “emotional capital.” Emotional capital is comprised of all the softer assets an owner has invested in his company: sacrificing weekends and evenings to develop the business instead of enjoying the company of family and friends, going the extra mile to save or develop an account, consistently forging better procedures, always stretching one more hour out of the day and one more day out of the week – the business of creating a business. After all, the entrepreneur often spends more time with his or her “business family” than his or her immediate family. And the “gap” between an outsider who is never exactly like you and is unlikely to treat the business like you treat it, the selling entrepreneur, is huge! But it can be bridged.

ESOPs & PEGs: A Strategic Match Made in Acronym Heaven

With over $302 billion raised in 2007 alone, Private Equity Groups (PEGs) have solidified themselves as a powerful force in the M&A market. The continued proliferation of PEGs, and monies flowing into the funds they control, has led to intense competition for acquisitions. As we move through 2008, weathering its uncertain economy and tenuous credit market, we expect to see strategic buyers playing stronger roles in the M&A market. PEGs will need to find new ways to compete using creative deal structures to off-set tighter credit markets. One alternative structuring method that may be effective is the use of an Employee Stock Ownership Plan (ESOP) as an acquisition tool. While PEGs have already begun to embrace ESOPs as a divestiture tool, there is less experience in using the ESOP structure as an acquisition strategy. Publicly featured last year in the controversial privatization of the Tribune Company, ESOPs have also proven to be a successful strategy for the middle market PEG for several reasons including tax advantages, borrowing capacity and cultural benefits.

Eager lenders, rising values, helpful legislation all contribute to a compelling environment for ESOPs. Subsequently, this is a terrific environment for business owners to consider an ESOP as a liquidity strategy. Credit is plentiful and recent relief on S-Corp. restrictions provides owners greater structuring flexibility.

Global Market Savvy is a Must for Today’s World

Achieving success in the global marketplace requires real-world experience with the challenges of working in foreign markets. Specialized knowledge is essential to ensuring liquidity, navigating the local trading markets, and managing social, political and economic risk.

In today’s business climate, business owners considering liquidity are facing challenging times in the marketplace. The reason: fewer buyers, with those active in the marketplace being more discerning in their acquisitions. In addition, businesses are receiving lower valuations compared to the historical values companies received a few years ago. And, it is most unlikely that high values will return to those record highs in the near future.

Meld je hier aan!

Recente berichten

Berichten geordend op tag

- Hide Date (199)

- Articles (175)

- M&A (101)

- Valuation (55)

- News (42)

- ESOP (29)

- Events (23)

- healthcare (17)

- Diversified Industrials (14)

- Building Products & Construction (13)

- Power & Energy (13)

- Banking, Finance & Insurance (12)

- Industry Reports (12)

- Advisory (10)

- Aerospace & Defense (9)

- E-books (7)

- IT & Telecom (6)

- Transportation & Logistics (5)

- Private Equity (4)

- PE (3)

- Uncategorized (3)

- Business Services (2)

- Case Studies (2)

- business owner (2)

- due diligence (2)

- Consumer & Food (1)

- ESOP Valuations (1)

- Tri-City Electrical (1)

- acquisition (1)

- acquisitions (1)

- category/test (1)

- construction (1)

- crane rental (1)

- cybersecurity (1)

- international (1)

- recapitalization (1)

- representations and warranties (1)

- reps and warrants (1)

- strategy (1)

- valuation gap (1)

MAFSI IS… Everywhere food is. And everywhere you are.

275 rep agencies, 260 manufacturers and 2,400 members strong. Spanning North America, feeding 300 million people and changing an industry.

Contact Us

Atlanta, GA 30307