RIDGEWOOD, NJ - PCE Investment Bankers, a leading financial services firm for mid-market companies, offering clients a full range of investment banking, ESOP, valuation, and advisory services, is pleased to announce that Burkhalter Rigging (Burkhalter) has recently recapitalized its debt with PNC Bank. This transaction will support future growth initiatives and create access to new sources of funds for Burkhalter. PCE served as exclusive financial advisor to Burkhalter and sourced the capital.

Topics: Power & Energy, Transportation & Logistics, Diversified Industrials, News

Attendance at this year’s WINDPOWER conference was down, but the mood did not match. Below are some takeaways from the conference.

Topics: Articles, Power & Energy, Hide Date, M&A

Currently the stock market is doing well, optimism in the economy is good, and debt remains cheap. All of these factors have created a robust M&A market for companies across many sectors with good companies achieving valuations that strong companies would normally achieve. This is expected to continue. For company owners and sell-side advisors that is great news. At this stage, when activity levels are high the smart money should strive for acquisitions that will have sustainable revenue during the inevitable downturn. This is a more defensive strategy due to its counter-cyclical nature.

Topics: Articles, Power & Energy, M&A

Appetite for Industrial Companies Remains Insatiable

In the merger and acquisition market there have been many flavors of the month, but the demand for industrial companies is the equivalent of chocolate: almost universally and consistently liked by acquirers. Industrial companies including, manufacturing, distribution and services, are a significant portion of the American economy and will remain so well into the future. At one time, the demise of the industrial sector was predicted as low cost manufacturing transitioned overseas. In recent years the demand for industrial products produced in the U.S. has expanded. Throughout these differing viewpoints M&A activity in the industrial sector has remained strong.

Topics: Articles, Power & Energy, Diversified Industrials, M&A

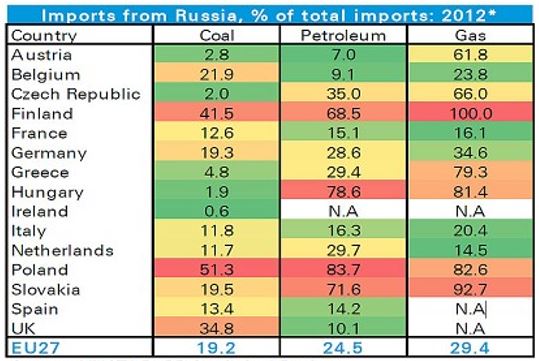

Oil and Gas Troubles in the East Create Opportunities in the West

The recent events in Ukraine are likely to have significant effects on the global market for natural gas with the likely winners being non-Russian companies that fulfill the demand for this commodity. Current events have proven that Russia, whose credibility in this sector was marginal to begin with, cannot be counted on as a partner that can reliably deliver natural gas to customers. Today, Russia is the dominant provider of natural gas to many European countries, due to their abundant supply. Although there is great economic incentive for Russia to build a consistent and reliable supply chain, this natural resource has become a political weapon for the Russian government.

Topics: Articles, Power & Energy, Diversified Industrials, Hide Date, M&A

Positive Energy Flowing Through America – an M&A Perspective

America’s power generation capabilities are in the midst of a monumental change that is altering the landscape and natural gas is not the only source creating positive momentum. Renewable energy, and in particular wind, is competing on price with the assistance of the Production Tax Credit (PTC), and should be able to exist without this subsidy in the near future. This improvement in price is causing utilities to take a portfolio approach to their investment in new power generation by diversifying resources.

Topics: Articles, Power & Energy, Hide Date, M&A

Wind power has a history of boom and bust cycles which has created a significant challenge for investors that are seeking to deploy capital in this sector. Currently, wind is highly dependent on government subsidies that need to be renewed periodically. The most recent extension, which was passed in early January 2013, has created a significant opportunity over the next two years, but what happened at the end of 2012 was very telling.

Topics: Articles, Power & Energy, Hide Date, M&A, category/test

The supply of global energy appears to be shifting and the United States is the primary beneficiary. According to the recent International Energy Agency’s (IEA) World Energy Outlook, the world is in the process of significantly changing the countries that supply fuels as well as the types of fuels used to provide power around the world. The headline from the report states that the global energy map is changing with the primary impetus being unconventional oil and gas production in the United States. Access to unconventional sources of oil and gas has expanded production, which has led to greater resources and better fuel pricing, spurring economic activity and changing the face of global energy trade. As a result, this and related sectors should expect high levels of investment and power industry M&A activity for many years to come.

Topics: Articles, Power & Energy, Hide Date, M&A

Fukushima Daiichi’s Effect on M&A in the Power Industry

The Japanese tsunami and resulting tragic accident at the Fukushima Daiichi nuclear power plant forced a pause in the growing positive sentiment behind this source of power. While opinions appear to have turned against growth in this sector there is still substantial infrastructure that needs to be maintained. These factors might have led a number of investors and acquirers to move away from this segment and focus on other parts of the power industry. The transaction data disputes this and shows that interest in companies that serve the nuclear industry remains strong.

Topics: Articles, Power & Energy, Hide Date, M&A

The abundance of natural gas in the U.S. has resulted in a number of interesting circumstances. First, the supply of natural gas has increased to the point where storage facilities are close to capacity. Second, due to high levels of supply prices have dropped dramatically, which has resulted in a greater proportion of the U.S.’s power generation being derived from this fuel. Third, prices are expected to remain low due to the high levels of supply that have yet to be tapped. Fourth, the infrastructure to transport the natural gas from the point of extraction to the end user is still being built. Fifth, natural gas is accepted as a cleaner fuel for power generation. This confluence of factors has created depressed prices for natural gas, but the segments that use and support the extraction and use of natural gas are experiencing exceptional growth not only in revenues and profits, but also merger and acquisition activity.

Topics: Articles, Power & Energy, Hide Date, M&A

Meld je hier aan!

Recente berichten

Berichten geordend op tag

- Hide Date (199)

- Articles (175)

- M&A (101)

- Valuation (55)

- News (42)

- ESOP (29)

- Events (23)

- healthcare (17)

- Diversified Industrials (14)

- Building Products & Construction (13)

- Power & Energy (13)

- Banking, Finance & Insurance (12)

- Industry Reports (12)

- Advisory (10)

- Aerospace & Defense (9)

- E-books (7)

- IT & Telecom (6)

- Transportation & Logistics (5)

- Private Equity (4)

- PE (3)

- Uncategorized (3)

- Business Services (2)

- Case Studies (2)

- business owner (2)

- due diligence (2)

- Consumer & Food (1)

- ESOP Valuations (1)

- Tri-City Electrical (1)

- acquisition (1)

- acquisitions (1)

- category/test (1)

- construction (1)

- crane rental (1)

- cybersecurity (1)

- international (1)

- recapitalization (1)

- representations and warranties (1)

- reps and warrants (1)

- strategy (1)

- valuation gap (1)

MAFSI IS… Everywhere food is. And everywhere you are.

275 rep agencies, 260 manufacturers and 2,400 members strong. Spanning North America, feeding 300 million people and changing an industry.

Contact Us

Atlanta, GA 30307