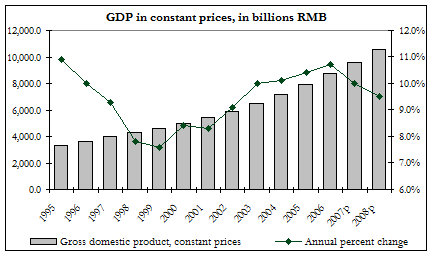

Managing the sale of a U.S. based company with worldwide operations – that included a fast growing facility in China – enabled me to learn firsthand what challenges and opportunities U.S. businesses encounter in the Far East. Middle market companies with operations in China are well positioned to receive a premium price from strategic and financial acquirers due to the vast opportunity this country represents. Most middle market companies in this segment are limited not by the prospects, but the access to capital to meet the growing demands of an ever-expanding marketplace. For American corporations, China represents an explosive growth opportunity that can have a highly accretive effect on the value of a business.

The Impact of Large Biotechnology Centers on Florida’s Economy

Florida’s commitment to forming a biotechnology cluster within the state will have significant impact on both the healthcare industry and Florida’s overall economy during the next 10 to 15 years. During the last four years, the state has earmarked nearly $700 million in incentive plans to help attract two of the largest biotechnology research institutes in the world, the Scripps Research Institute and the Burnham Institute.

Topics: Articles, healthcare, Hide Date, IT & Telecom, M&A

In the world of finance, money is more than a mere measurement of wealth – it’s almost as revered as a religion. Based on the attendance at this year’s ACG (Association of Capital Growth) National Conference, this annual gathering of the financial faithful may soon be known as the “mecca of finance.” What began three years ago with fewer than 500 attendees has exploded into an enormous event attracting nearly 2,000 finance professionals, no small feat since each attendee paid a substantial registration fee.

Topics: Articles, Hide Date, Banking, Finance & Insurance, M&A

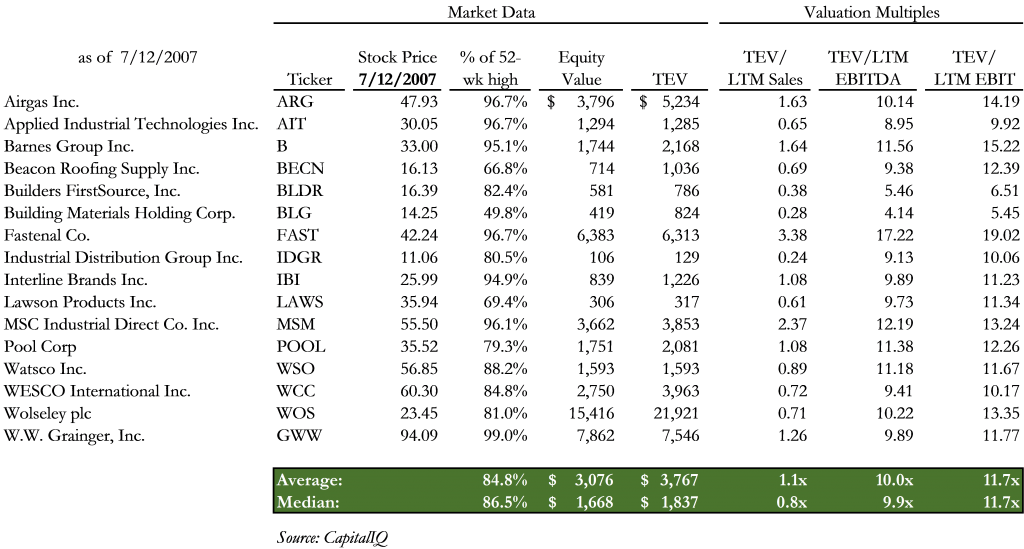

Wholesale Distribution: Valuation and M&A Activity Robust

Capital from financial institutions, strategic buyers, private equity firms and individuals continues to flow into the wholesale distribution industry. This influx has led to strong valuations for publicly traded distributors and solid transaction multiples for operators who sold businesses. In our opinion, two main fundamental drivers lead this charge – the attractiveness of the distribution industry and the current availability of capital.

Topics: Articles, Diversified Industrials, Hide Date, M&A

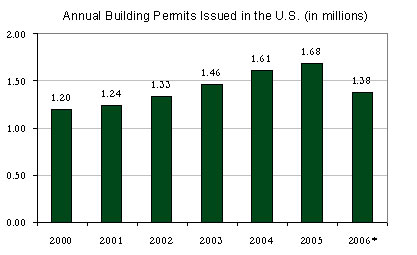

The dramatic reversal of the home building industry raised concerns of a far reaching domino effect in which the entire US economy weakened into recession. One contravening factor has been the strength of the non-residential construction industry, experiencing a significant surge of its own, and helping to mop up the unemployment created from the housing downturn.

Topics: Articles, Hide Date, Building Products & Construction, M&A

Florida Healthcare Industry – Prevention vs. Treatment

Prevention versus treatment. One might assume investment dollars flow freely into preventative care based on the overall media coverage. However, having just returned from the largest bio-healthcare conference of the year, I can tell you that investing in treatment (pharmaceuticals, medical devices, health insurance, etc.) is still king and has no near-term threat of being overthrown. Approximately four percent of the $2 trillion spent annually on healthcare is earmarked for prevention. So it is easy to understand the investor focus on treatment.

Topics: Articles, healthcare, Hide Date, M&A

Florida Home Building & Construction – All Building is Local

The tides in Nova Scotia’s Bay of Fundy are the most extreme in the world with a 56 foot variance between high and low. Consequently, Canadian fishermen value how well the ship’s captain knows each and every prominence and tributary.

Topics: Articles, Hide Date, Building Products & Construction, M&A

As private equity transactions increase, the need for junior capital (second lien loans and mezzanine debt) has risen exponentially. According to Standard & Poor’s, the average middle market deal for the second quarter of 2006 ($50 MM in EBTIDA or less) was funded using 40% equity, 40% senior debt and 20% junior capital. The recent historically low interest rates made second lien financing attractive in larger deals with greater collateral. Therefore, the need for traditional mezzanine financing was reduced and was primarily used to bridge the gap between the second lien and the equity.

Topics: Articles, Hide Date, Banking, Finance & Insurance, M&A

The current push from business and government to shift healthcare responsibility and costs to individual consumers, often called Consumer Directed Healthcare, is laying the groundwork for the creation of a wide array of new kinds of businesses, services and products, with many health care providers turning to mergers and acquisitions as the fastest way to meet the new demand.

Topics: Articles, healthcare, Hide Date, M&A

One of the toughest questions a business owner will ultimately face is when to sell the company. But once that decision is made, a host of other questions arise: How do I ensure I get the best value for my company? Do I want to walk away completely or retain some ownership and How long do I need to stay on after the sale to ensure the transition goes smoothly? And what about my employees, how do I make sure their loyalty and support is rewarded and their future secure? And that dreaded of all questions, how do I minimize the tax bite?

Meld je hier aan!

Recente berichten

Berichten geordend op tag

- Hide Date (199)

- Articles (175)

- M&A (101)

- Valuation (55)

- News (42)

- ESOP (29)

- Events (23)

- healthcare (17)

- Diversified Industrials (14)

- Building Products & Construction (13)

- Power & Energy (13)

- Banking, Finance & Insurance (12)

- Industry Reports (12)

- Advisory (10)

- Aerospace & Defense (9)

- E-books (7)

- IT & Telecom (6)

- Transportation & Logistics (5)

- Private Equity (4)

- PE (3)

- Uncategorized (3)

- Business Services (2)

- Case Studies (2)

- business owner (2)

- due diligence (2)

- Consumer & Food (1)

- ESOP Valuations (1)

- Tri-City Electrical (1)

- acquisition (1)

- acquisitions (1)

- category/test (1)

- construction (1)

- crane rental (1)

- cybersecurity (1)

- international (1)

- recapitalization (1)

- representations and warranties (1)

- reps and warrants (1)

- strategy (1)

- valuation gap (1)

MAFSI IS… Everywhere food is. And everywhere you are.

275 rep agencies, 260 manufacturers and 2,400 members strong. Spanning North America, feeding 300 million people and changing an industry.

Contact Us

Atlanta, GA 30307