We are in the midst of one of the most dynamic periods of “creative destruction” (a borrowed phrase made famous by economist Joseph Schumpeter) as a result of our current recession, or depression if you have been severely impacted, as many have. This is the time to replace old ways with a new paradigm.

Facing Creative Destruction: Time to Revitalize Capital

Merger and acquisition activity began to pick up in 2Q09 as markets bounced back from the low experienced in 1Q09. After the substantial drop off from 4Q08 to 1Q09, M&A activity increased as more buyers and sellers tested the market. Financial and strategic acquirers began to actively seek opportunities across nearly all sectors due to the widely held assumption that transaction values have decreased, providing the opportunity for higher returns. This belief, coupled with substantial capital waiting to be deployed, should help increase activity in the coming months. Additionally, business owners, having lowered their valuation expectations, should see an opportunity to affiliate with a well capitalized partner that can help position their company’s future growth when the economy rebounds, as well as pull some money out of their company.

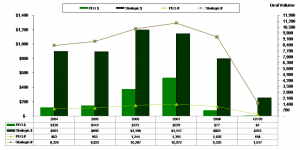

The dramatic decline in M&A activity over the past 12 months has seen an equally precipitous drop in Private Equity’s (PE’s) share in the M&A market. As the chart below highlights, M&A transaction volume peaked in 2007 with over 12,000 transactions and $1.7 trillion in value.

Topics: Articles, Hide Date, Banking, Finance & Insurance, M&A

Analysis of the American Recovery and Reinvestment Act of 2009

Topics: Articles, Power & Energy, Transportation & Logistics, Hide Date, Building Products & Construction, M&A

Aerospace & Defense: Selling One’s Business During a Recession

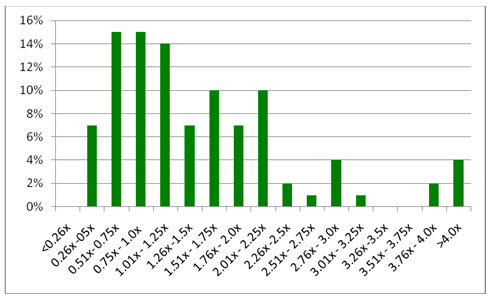

Across almost every aerospace industry segment, pricing multiples are down, and owners of middle-market businesses considering the sale of their businesses are anxious over the recession’s impact on upcoming decisions to sell.

Topics: Aerospace & Defense, Articles, Hide Date, M&A

The recent economic downturn has been financially challenging for many businesses. Existing credit lines have been reduced, new loans from commercial lenders are more difficult to obtain, and accessing the public capital markets is likely not an option. So in this difficult market climate, where does a middle-market company turn for financing? The answer may be mezzanine capital.

Topics: Articles, Hide Date, Banking, Finance & Insurance, M&A

PCE recently participated on a panel regarding “Capital Markets Trends in Distribution” at the Strategic Pricing Associates Distribution Strategy Seminar in Fort Lauderdale, Florida. In attendance were owners and senior executives from over 70 different distributors and manufacturers across all major industries.

Topics: Articles, Diversified Industrials, Hide Date, M&A

As expected, there was a significant decrease in mergers and acquisitions activity and valuations in 1Q09. During the first quarter the markets were still sifting through all the events that took place in the final four months of 2008 and the resulting uncertainty. In addition, expectations were high as the Obama Administration took the reins of power. Although progress was made on many fronts in the first quarter, many acquirers determined that it was best to sit on the sidelines due to tight credit markets and the high levels of economic and market uncertainty.

Assessing Outside Capital for Stability, Growth and Liquidity

The current recession in the U.S. has created a range of opportunities and difficulties for most mid-market companies. While some have tightened their belts as taught as possible to weather the downturn others are using stronger positions to their advantage to take market share or complete acquisitions. In both of these cases the highly coveted and valued resource today called “capital” is needed to successfully execute either strategy.

Topics: Articles, Hide Date, Banking, Finance & Insurance, M&A

While the current economic environment and financial market meltdown have most business owners focused on conserving cash, controlling/reducing headcount and holding on for dear life, most of the wealthiest individuals in the world (including Mr. Buffett) will likely tell you that it is in these uncertain times that fortunes are made. Our belief is that this is true for distribution and industrial businesses that have the capital and courage to pursue strategic acquisitions in 2009. Valuations have meaningfully decreased and most of the attractive factors of the distribution marketplace remain – it is a large, diversified and growing market with considerable consolidation potential. A similar situation presented itself after the 2001/2002 slowdown and many distributors benefited handsomely from well-timed, highly strategic acquisitions.

Topics: Articles, Hide Date, Banking, Finance & Insurance, M&A

Meld je hier aan!

Recente berichten

Berichten geordend op tag

- Hide Date (199)

- Articles (175)

- M&A (101)

- Valuation (55)

- News (42)

- ESOP (29)

- Events (23)

- healthcare (17)

- Diversified Industrials (14)

- Building Products & Construction (13)

- Power & Energy (13)

- Banking, Finance & Insurance (12)

- Industry Reports (12)

- Advisory (10)

- Aerospace & Defense (9)

- E-books (7)

- IT & Telecom (6)

- Transportation & Logistics (5)

- Private Equity (4)

- PE (3)

- Uncategorized (3)

- Business Services (2)

- Case Studies (2)

- business owner (2)

- due diligence (2)

- Consumer & Food (1)

- ESOP Valuations (1)

- Tri-City Electrical (1)

- acquisition (1)

- acquisitions (1)

- category/test (1)

- construction (1)

- crane rental (1)

- cybersecurity (1)

- international (1)

- recapitalization (1)

- representations and warranties (1)

- reps and warrants (1)

- strategy (1)

- valuation gap (1)

MAFSI IS… Everywhere food is. And everywhere you are.

275 rep agencies, 260 manufacturers and 2,400 members strong. Spanning North America, feeding 300 million people and changing an industry.

Contact Us

Atlanta, GA 30307