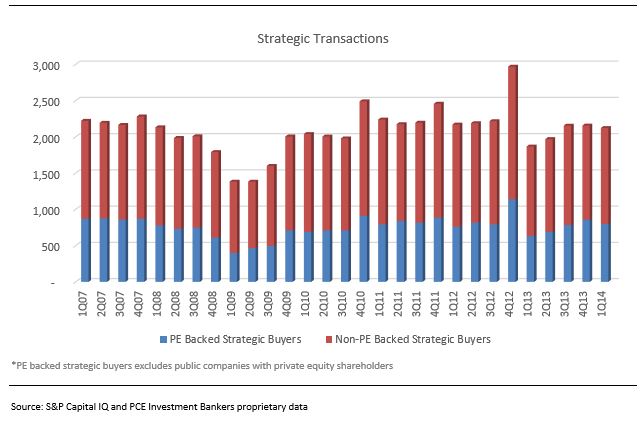

Private Equity (PE) has a strong influence on the M&A market that goes beyond the initial platform transaction (PE Platform Transactions). PE Platform Transactions have steadily represented a low percentage of the total transaction volume over the past few years. Since the beginning of 2007, PE Platform Transactions have stayed within a band of 8% to 10% of total transaction volume on a quarterly basis. This data would lead one to believe that PE’s influence on the M&A market is minimal. However, a deeper analysis shows that PE portfolio companies represent a meaningful percentage of strategic acquisitions (PE Backed Transactions).

State of the M&A Market: Private Equity’s Compounding Influence

Oil and Gas Troubles in the East Create Opportunities in the West

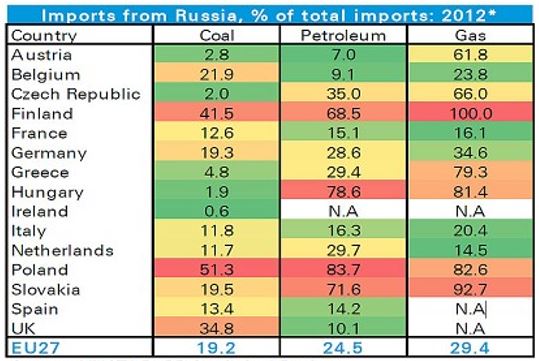

The recent events in Ukraine are likely to have significant effects on the global market for natural gas with the likely winners being non-Russian companies that fulfill the demand for this commodity. Current events have proven that Russia, whose credibility in this sector was marginal to begin with, cannot be counted on as a partner that can reliably deliver natural gas to customers. Today, Russia is the dominant provider of natural gas to many European countries, due to their abundant supply. Although there is great economic incentive for Russia to build a consistent and reliable supply chain, this natural resource has become a political weapon for the Russian government.

Topics: Articles, Power & Energy, Diversified Industrials, Hide Date, M&A

M&A Upswing for Building Products & Construction Industry

We have started to experience greater interest in the Building Products / Construction sector over the past few months. This attention is both from owners and buyers – equally strategic and private equity. Clearly the increased activity in the residential and commercial building arena has brought awareness of improving revenues and profitability.

Topics: Articles, Hide Date, Building Products & Construction, M&A

State of the M&A Market: “Hot Industries” an Oxymoron in 2013?

I guess it depends on how you classify “hot industries”. Hot in 2013 would be better depicted as cool with a touch of lukewarm, tepid at best. Of the ten industries defined and tracked by PCE, nine saw a drop in transaction volume during the year. The sole gainer, consumer discretionary, improved upon its 2012 volume by a mere 2.0%.

Is it the flu or a more chronic illness? As measured by pre-2010 transaction activity, deals were plentiful in 2013. However, most M&A professionals observed that 2013 ended with business owners and deal-makers on a more guarded note. The recent tepid mood shift is evident in 4th quarter 2013 M&A activity. Every sub-sector of healthcare experienced a drop in transaction volume except Equipment & Supply. See “PCE Industry Update – Healthcare 4th Quarter 2013” report.

Topics: Articles, healthcare, Hide Date, M&A

Private Equity (PE) transaction activity in 2013 has experienced a shift back to its historical pattern. Over the past twenty years the PE M&A transactions, both acquisitions and exits, in the U.S. have moved in congruence with PE capital raised except for the period 2010-2012. As the amount of capital raised has increased, so have PE transactions, and as the amount of capital raised has decreased, so have PE transactions. Although there is a correlation between PE transaction activity and PE capital raised throughout the full timeframe of 1995-2013 (R2=0.407, p=0.003)1,2, there is a significantly stronger correlation when the years 2010-2012 are excluded (R2=0.836, p<0.0001) 1,2.

Positive Energy Flowing Through America – an M&A Perspective

America’s power generation capabilities are in the midst of a monumental change that is altering the landscape and natural gas is not the only source creating positive momentum. Renewable energy, and in particular wind, is competing on price with the assistance of the Production Tax Credit (PTC), and should be able to exist without this subsidy in the near future. This improvement in price is causing utilities to take a portfolio approach to their investment in new power generation by diversifying resources.

Topics: Articles, Power & Energy, Hide Date, M&A

ACA a Healthcare Industry Game Changer for M&A Transactions

The President, Congress and supporters originally called the new healthcare legislation the Patient Protection and Affordable Care Act (PPACA). It was then shortened or referred to as the Affordable Care Act (ACA), and is now lovingly or perhaps disparagingly referred to as Obamacare by supporters and naysayers. Whatever you call the law, whatever you think about it, or whatever the final outcome, one thing is for certain, ACA has permanently changed the healthcare industry. The law is driving consolidation among healthcare payers and has spurred change and consolidation among the healthcare supplier and service provider industries.

Topics: Articles, healthcare, Hide Date, M&A

State of the M&A Market – Q2 2013

Cultivated by the globalization of business and the desire of foreign buyers to access sophisticated markets, the world appeared to have become a much smaller place through mid-year 2008. Buoyed by a soft U.S. dollar, the desire of foreign companies to acquire well-known brands and driven by the need to access advanced technologies, the U.S. became an attractive marketplace for takeover targets. As a result, investments in U.S. targets by non-domestic participants grew as a percent of total M&A transaction volume.

State of the M&A Market: Buyers Stay Close to Home

“Stay close to home” appears to be the mantra of most U.S. M&A transactions. Buyers purchased businesses close to home (in the same region) nearly 50% of the time in 2012. This “home proximity” increases to 75% when adjacent regions are included. This data from 2012 is not surprising, as this is a ten year trend in acquisitions. In 2002, 46% of U.S. M&A transactions, with a U.S. buyer and target, involved a buyer and target located in the same region. Between 2002 and 2012, the percentage of intraregional transactions varied slightly, depending on the market; however, it has never fluctuated more than 4% from the 2002 level.

Meld je hier aan!

Recente berichten

Berichten geordend op tag

- Hide Date (199)

- Articles (175)

- M&A (101)

- Valuation (55)

- News (42)

- ESOP (29)

- Events (23)

- healthcare (17)

- Diversified Industrials (14)

- Building Products & Construction (13)

- Power & Energy (13)

- Banking, Finance & Insurance (12)

- Industry Reports (12)

- Advisory (10)

- Aerospace & Defense (9)

- E-books (7)

- IT & Telecom (6)

- Transportation & Logistics (5)

- Private Equity (4)

- PE (3)

- Uncategorized (3)

- Business Services (2)

- Case Studies (2)

- business owner (2)

- due diligence (2)

- Consumer & Food (1)

- ESOP Valuations (1)

- Tri-City Electrical (1)

- acquisition (1)

- acquisitions (1)

- category/test (1)

- construction (1)

- crane rental (1)

- cybersecurity (1)

- international (1)

- recapitalization (1)

- representations and warranties (1)

- reps and warrants (1)

- strategy (1)

- valuation gap (1)

MAFSI IS… Everywhere food is. And everywhere you are.

275 rep agencies, 260 manufacturers and 2,400 members strong. Spanning North America, feeding 300 million people and changing an industry.

Contact Us

Atlanta, GA 30307