Wawa, Inc’s Employee Stock Ownership Plan (“ESOP”) has purchased additional stock from a trust comprised of members of the Company’s founding family, increasing their employees’ ownership stake in the convenience store chain. This is the first time the ESOP trust has purchased stock from the founding family. Wawa, headquartered in Pennsylvania, has stores in Pennsylvania, New Jersey, Delaware, Maryland, Virginia and most recently in Florida. PCE serviced as advisor to Wawa.

While it may seem at face value (pun intended) that the value of a note is equal to the outstanding principal balance; this is often not the case. The fair market value of a note is dependent on several factors, two of the most important being “counter-party risk,” which means the creditworthiness of the debtor, and cost of capital at the date of analysis. Understanding the creditworthiness of the debtor is the more complicated of the two, and potentially involves analyzing the debtor’s financial condition, and could involve a fairly complex analysis of an operating company, including an analysis of quality of assets and cash flows, the determination of a corporate credit score (Z-score), and other such analyses that are typical for underwriting debt. As an ancillary consideration, the lender should require access to relevant records so as to be able to perform such analyses if necessary.

Topics: Articles, Valuation, Hide Date, Banking, Finance & Insurance

New Office Now Open in Atlanta, New Colleagues Join Management Team

A Prescription for M&A – Compound Pharmacies Face Change

The compounding pharmacy industry is ripe for consolidation and many anticipate a pickup in M&A activity. As compounding pharmacist head to Washington, DC to attend the industry insiders “IACP’s 20th Compounders on Capitol Hill 2014” summit later this month, it is worthwhile to provide insight on this subsector.

Topics: Articles, healthcare, Hide Date, M&A

State of the M&A Market: Private Equity’s Compounding Influence

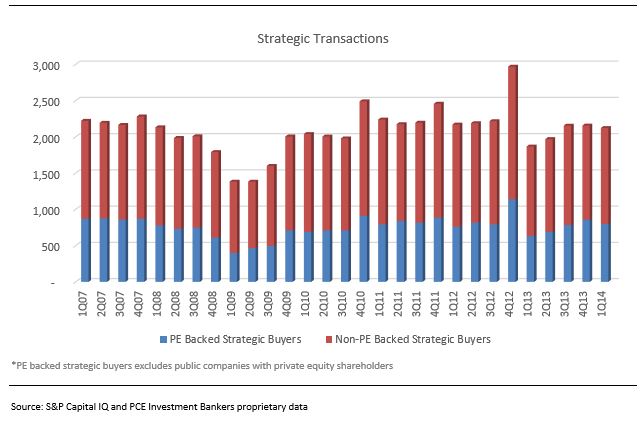

Private Equity (PE) has a strong influence on the M&A market that goes beyond the initial platform transaction (PE Platform Transactions). PE Platform Transactions have steadily represented a low percentage of the total transaction volume over the past few years. Since the beginning of 2007, PE Platform Transactions have stayed within a band of 8% to 10% of total transaction volume on a quarterly basis. This data would lead one to believe that PE’s influence on the M&A market is minimal. However, a deeper analysis shows that PE portfolio companies represent a meaningful percentage of strategic acquisitions (PE Backed Transactions).

Oil and Gas Troubles in the East Create Opportunities in the West

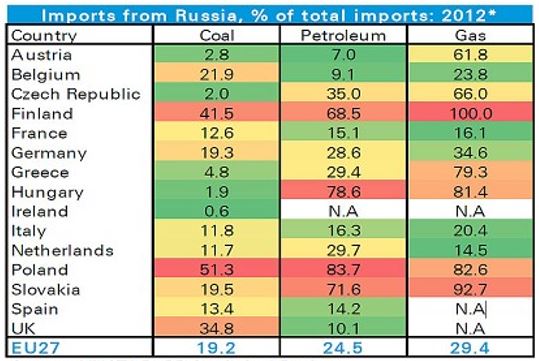

The recent events in Ukraine are likely to have significant effects on the global market for natural gas with the likely winners being non-Russian companies that fulfill the demand for this commodity. Current events have proven that Russia, whose credibility in this sector was marginal to begin with, cannot be counted on as a partner that can reliably deliver natural gas to customers. Today, Russia is the dominant provider of natural gas to many European countries, due to their abundant supply. Although there is great economic incentive for Russia to build a consistent and reliable supply chain, this natural resource has become a political weapon for the Russian government.

Topics: Articles, Power & Energy, Diversified Industrials, Hide Date, M&A

Who is in Your Corner? The Value of Hiring a True Expert

My good friend Peter Kawulia, 78, is a distinguished member of the Manitoba Sports Hall of Fame, and the third-ranked featherweight boxer in the history of the British Empire(1). In that Pete was never knocked out, and was cut only once in 115 bouts, he knows his way around the ring. If Pete were to share his thoughts he would undoubtedly say that regardless of his awe-inspiring talent, whom he had in his corner was crucial to his success. The heirs of Helen Richardson(2) recently learned the importance of this choice, as clearly they could have avoided a knockout and the resulting “medical bills” with the right professionals in their corner.

M&A Upswing for Building Products & Construction Industry

We have started to experience greater interest in the Building Products / Construction sector over the past few months. This attention is both from owners and buyers – equally strategic and private equity. Clearly the increased activity in the residential and commercial building arena has brought awareness of improving revenues and profitability.

Topics: Articles, Hide Date, Building Products & Construction, M&A

PCE Advises Physician Associates on Sale to Orlando Health

PCE advised Physician Associates, LLC on its sale to Orlando Health. PCE acted as exclusive valuation and financial advisor to Physician Associates.

Meld je hier aan!

Recente berichten

Berichten geordend op tag

- Hide Date (199)

- Articles (175)

- M&A (101)

- Valuation (55)

- News (42)

- ESOP (29)

- Events (23)

- healthcare (17)

- Diversified Industrials (14)

- Building Products & Construction (13)

- Power & Energy (13)

- Banking, Finance & Insurance (12)

- Industry Reports (12)

- Advisory (10)

- Aerospace & Defense (9)

- E-books (7)

- IT & Telecom (6)

- Transportation & Logistics (5)

- Private Equity (4)

- PE (3)

- Uncategorized (3)

- Business Services (2)

- Case Studies (2)

- business owner (2)

- due diligence (2)

- Consumer & Food (1)

- ESOP Valuations (1)

- Tri-City Electrical (1)

- acquisition (1)

- acquisitions (1)

- category/test (1)

- construction (1)

- crane rental (1)

- cybersecurity (1)

- international (1)

- recapitalization (1)

- representations and warranties (1)

- reps and warrants (1)

- strategy (1)

- valuation gap (1)

MAFSI IS… Everywhere food is. And everywhere you are.

275 rep agencies, 260 manufacturers and 2,400 members strong. Spanning North America, feeding 300 million people and changing an industry.

Contact Us

Atlanta, GA 30307