Nearly every industry feels stressed from current economic conditions but none has suffered more than construction. The federal stimulus plan was expected to offset declines in new construction but the projects funded have been slow to come to fruition. As a result, construction and construction related companies that enjoyed an extended period of significant capital expenditures now struggle with high debt payments while revenues, profits and cash flow continue to decrease. Compared to 2008, bankruptcy filings for construction companies increased by over 100%.

Topics: Articles, Hide Date, Banking, Finance & Insurance, M&A

Restructuring the Balance Sheet of an ESOP Owned Company

This year is expected to be full of opportunity for many privately held companies, including those owned by Employee Stock Ownership Plans (ESOPs). An essential component for companies to take advantage of these opportunities is a proper capital structure.

After a challenging start, 2009 ended with some positive momentum. Expectations going into the year were low due to the severe economic downturn experienced at the end of 2008. As the year progressed the M&A markets became more comfortable with the state of the economy and the initial stages of the recovery. During 2009, activity improved leading many to believe that 2010 has the potential to be a better year for M&A transactions. Additionally, a new report from Towers Watson and Cass Business School determined that publicly traded companies which undertook acquisitions in 2009 outperformed the market, providing evidence of the value acquisitions offer.

PCE Investment Bankers, Inc. served as the financial advisor to Grainger (NYSE: GWW), North America’s leading broad line distributor of facilities maintenance products, in the acquisition of Imperial Supplies LLC from American Capital, Ltd. PCE, which offers a full range of investment banking services, is recognized as a mergers and acquisitions specialist and experienced in all market sectors.

There are so many timely and topical valuation issues today that it’s difficult to focus on a single subject. Many topics remain timely month after month, like the importance of establishing the value of a company for purposes of buying cross-purchase life insurance. Some topics are always important, but become more timely because of economic conditions, like the increased ability to transfer assets for estate planning purposes while valuations are depressed (as we’ve been saying for some time, the current economic environment provides an outstanding opportunity in the estate planning realm). Another topic that is always important is consideration of entity selection for companies. A number of factors make this topic even more important today.

The recent M&A market has been defined by many different types of buyers, but the most publicized has been the consolidators. The consolidation of the financial industry has dominated the headlines, only rivaled in press coverage by the reorganization of the auto industry. Step away from the public markets and the headlines and you see similar behavior taking place amongst privately-held companies. Whether a company is unable to survive in this economy or an owner wants to relieve some management responsibility, many business owners are seeking to sell their company or merge with strong partners. Due to the significant tax advantages that are provided to companies that have Employee Stock Ownership Plans (ESOPs), they often fill this position of strong partner and end up as consolidators.

Facing Creative Destruction: Time to Revitalize Capital

We are in the midst of one of the most dynamic periods of “creative destruction” (a borrowed phrase made famous by economist Joseph Schumpeter) as a result of our current recession, or depression if you have been severely impacted, as many have. This is the time to replace old ways with a new paradigm.

Seller Financed ESOPs: Certainty to Close at an Attractive Value

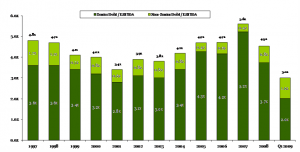

The challenges that many of the country’s banks are experiencing are very well publicized and are affecting financing for companies of all sizes and across all industries. Some companies that were once coveted credits of the banking industry are now having trouble renewing senior facilities or are having them renewed under more onerous terms in spite of continued performance. Banks have also pulled back on the amount of financing they are extending to buyers of companies that want to rely on financing to support the purchase (exhibit 1). This has had several effects on the M&A market; lower transaction multiples, more reliance on equity as capital for the acquisition and higher return expectations on investments.

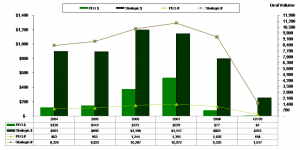

Merger and acquisition activity began to pick up in 2Q09 as markets bounced back from the low experienced in 1Q09. After the substantial drop off from 4Q08 to 1Q09, M&A activity increased as more buyers and sellers tested the market. Financial and strategic acquirers began to actively seek opportunities across nearly all sectors due to the widely held assumption that transaction values have decreased, providing the opportunity for higher returns. This belief, coupled with substantial capital waiting to be deployed, should help increase activity in the coming months. Additionally, business owners, having lowered their valuation expectations, should see an opportunity to affiliate with a well capitalized partner that can help position their company’s future growth when the economy rebounds, as well as pull some money out of their company.

The dramatic decline in M&A activity over the past 12 months has seen an equally precipitous drop in Private Equity’s (PE’s) share in the M&A market. As the chart below highlights, M&A transaction volume peaked in 2007 with over 12,000 transactions and $1.7 trillion in value.

Topics: Articles, Hide Date, Banking, Finance & Insurance, M&A

Meld je hier aan!

Recente berichten

Berichten geordend op tag

- Hide Date (199)

- Articles (175)

- M&A (101)

- Valuation (55)

- News (42)

- ESOP (29)

- Events (23)

- healthcare (17)

- Diversified Industrials (14)

- Building Products & Construction (13)

- Power & Energy (13)

- Banking, Finance & Insurance (12)

- Industry Reports (12)

- Advisory (10)

- Aerospace & Defense (9)

- E-books (7)

- IT & Telecom (6)

- Transportation & Logistics (5)

- Private Equity (4)

- PE (3)

- Uncategorized (3)

- Business Services (2)

- Case Studies (2)

- business owner (2)

- due diligence (2)

- Consumer & Food (1)

- ESOP Valuations (1)

- Tri-City Electrical (1)

- acquisition (1)

- acquisitions (1)

- category/test (1)

- construction (1)

- crane rental (1)

- cybersecurity (1)

- international (1)

- recapitalization (1)

- representations and warranties (1)

- reps and warrants (1)

- strategy (1)

- valuation gap (1)

MAFSI IS… Everywhere food is. And everywhere you are.

275 rep agencies, 260 manufacturers and 2,400 members strong. Spanning North America, feeding 300 million people and changing an industry.

Contact Us

Atlanta, GA 30307