As we await the U.S. Supreme Court review of President Obama’s healthcare overhaul and find ourselves deep in the century-long American debate over healthcare, three issues seem clear for this industry in transition. First, regardless of the Supreme Court rulings, coverage as we have historically known it will expand and more Americans will be able to access that coverage. The issue is how much will this market grow. Second, cost and the containment of those costs must be streamlined across the healthcare value chain. And finally, businesses involved in all areas of the healthcare industry will continue to consolidate in an effort to lower cost and increase coverage or market share. Whatever one’s political views or vision of the future, these issues are the core strategic drivers of change and are at the center of driving mergers and acquisition in the U.S. healthcare industry. Obviously, the Supreme Court decision matters. Whatever the decision, these issues will continue to drive the transformation that has been set in place and will continue to fuel M&A.

Topics: Articles, healthcare, Hide Date, M&A

The industrial services sector is undergoing a resurgence as merger and acquisition activity continues to grow. As with most sectors, transaction activity decreased substantially after the economic downturn in 2008. The industrial services sector was hit particularly hard due to cutbacks in spending by the private and public sectors.

Topics: Articles, Diversified Industrials, Hide Date, M&A

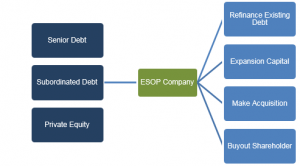

ESOP Owned Companies: The Valentine’s Day Edition

It’s Valentine’s Day, love is in the air and ESOP owned companies have suitors lining up at their doors in the form of banks and other capital providers attempting to woo them. The fact that ESOP owned companies outperformed their competitors during the most recent recession is only one of the reasons that ESOP owned companies are finding an array of capital providers eager to finance their growth plans, acquisitions or ESOP stock purchases. ESOP owned companies are better borrowers due to their tax benefits as well as the continuity of the employee base and management team. As this becomes more widely known, it is a great time for ESOP owned companies to explore their options for financing and to be sure that they are aligning themselves with the best partners as they continue to grow and transition ownership.

Healthcare Industry M&A Activity Within the IT Subsector Thrives

Summertime typically signals a slow down for mergers and acquisition activity, especially for technology-based businesses. The Nasdaq’s lackluster performance during summer indicates investors tend to ignore this sector in anticipation of the latest technology gadget or new game-changing systems that normally are unveiled as autumn approaches. However, recent M&A activity impacting information technology (IT) companies servicing the healthcare industry has been far from stagnant.

Topics: Articles, healthcare, Hide Date, IT & Telecom, M&A

America’s power sector is at a crossroads. Rising demand for clean forms of power is now juxtaposed against the growing need for inexpensive energy, creating a situation that is increasingly conflicted. Recent economic challenges have made decisions even more difficult for electric power producers. In 2009, electricity generation decreased 4.1 percent, settling at its lowest level since 2003, representing the largest decline in six decades. In addition to the recent economic downturn, expanding environmental policy and increasing prices of certain fuels have forced electric power producers to invest in alternatives to coal such as natural gas. Investment decisions also have been impacted by the recent accident at a nuclear power plant in Japan that, at least temporarily, diminished renewed enthusiasm for nuclear power expansion. Alternatively, renewable energy has been fully embraced by some for its clean energy benefits, federal production and investment tax credits and cash grants, as well as help electric power producers comply with state Renewable Portfolio Standards (RPS). Even in the face of uncertainty about future tax and energy policies, investment in renewable and conventional forms of power is expected to remain strong as older, less efficient power plants are retired and demand continues to build. The U.S. Department of Energy projects that demand will increase approximately 24 percent by 2035, rising roughly 1 percent per year. Which source of power will benefit the most is uncertain. What is clear is that all of these sectors have characteristics that will ensure future investment.

Power Sources

Key factors facing the power industry include:

Topics: Articles, Power & Energy, Hide Date, M&A

Bipartisanship at Work – ESOP Legislation Supported by Both Sides of the Aisle

While recently attending the Employee-Owned S Corporation of America (ESCA) Federal Policy Conference in Washington DC, I was struck by the fact that both Democrat and Republican congressional leaders who spoke at the conference were in support of current legislation that expands the idea of broad based employee ownership in privately held companies. A quick review of the conference material confirmed that Senators and Congressman, Republicans and Democrats in attendance championed the idea of employee ownership, and supported the idea that the current legislation promoting Employee Stock Ownership Plans (ESOPs) needed to be preserved and expanded. Who knew ESOPs would be the issue where the two parties could find common ground, but ESOPs are an ownership transition strategy that works in both concept and practice for both owners and employees. This bipartisan support of ESOPs has led to broad based support for two new pieces of legislation currently in front of the House of Representatives (HB 1244) and in front of the Senate (SB 1512), both of which would enable more business owners and companies to take advantage of the ESOP option when evaluating liquidity options for their privately held stock. As a sign of the bipartisan nature of these pieces of legislation, 41 congressman co-sponsored HB 1244 of which 22 are Republican and 19 are Democrats.1ESOP legislation was originally crafted in 1974 as a partial response to concerns over shortfalls in social security. With the exception of a major revision in 1996, the legislation has largely remained intact. Why are ESOPs getting more attention now? Because our elected leaders are all focusing on growing small businesses, expanding jobs and ensuring Americans are provided for in their retirement years. ESOPs address all of those initiatives, and are a concept that works and deserves to be expanded. The evidence shows that ESOP-owned companies have several characteristics that benefit the general economy, including:

Following a dynamic first half of 2011, M&A activity saw a slight decline in the third quarter. Volatility in the equity markets, global economic uncertainty, and seasonal slowing negatively impacted transaction volume. As skepticism in the market place continues to linger, buyers have been cautious in putting cash to work. Despite the challenges facing the market’s participants, deal makers remain committed as year-over-year performance gains traction.

Financial Reporting Valuation – The Market Participant

ASC 820 – Fair Value Measurements and Disclosures sets forth the definition of Fair Value as “The price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date”. Paramount to the definition is the concept of the “market Participant”. The Market Participant is further defined in ASC 820 as “…buyers and sellers in the principal (or most advantageous) market for the asset or liability that have all of the following characteristics:

Fair Market Value Case Study – Not Your Typical Valuation

We’re often asked about the most interesting valuation issues we’ve encountered. This is difficult to answer because each valuation has unique intricacies and difficulties. While some share similarities, no two are identical. Still, a few stand out as presenting unique valuation issues. We recently worked on one such project.

Fractional Interest – “Minority Premium”?….Really?

I recently read a short description of a presentation made by an IRS Engineer Team Manager at the National IRS Symposium sponsored by the American Society of Appraisers (ASA). The presentation addressed the application of discounts to fractional interests, and asserted that certain levels of discounts amounted to a “minority premium” for certain non-controlling interests. The speaker presented a financial model that suggested certain caps on the discounts applicable to fractional interests. Much of the logic behind the model and the theory are valid in a world where one considers specific buyers. However, when applying Fair Market Value (FMV), the theory quickly disintegrates into an attempt to ignore the proper standard of value.

Meld je hier aan!

Recente berichten

Berichten geordend op tag

- Hide Date (199)

- Articles (175)

- M&A (101)

- Valuation (55)

- News (42)

- ESOP (29)

- Events (23)

- healthcare (17)

- Diversified Industrials (14)

- Building Products & Construction (13)

- Power & Energy (13)

- Banking, Finance & Insurance (12)

- Industry Reports (12)

- Advisory (10)

- Aerospace & Defense (9)

- E-books (7)

- IT & Telecom (6)

- Transportation & Logistics (5)

- Private Equity (4)

- PE (3)

- Uncategorized (3)

- Business Services (2)

- Case Studies (2)

- business owner (2)

- due diligence (2)

- Consumer & Food (1)

- ESOP Valuations (1)

- Tri-City Electrical (1)

- acquisition (1)

- acquisitions (1)

- category/test (1)

- construction (1)

- crane rental (1)

- cybersecurity (1)

- international (1)

- recapitalization (1)

- representations and warranties (1)

- reps and warrants (1)

- strategy (1)

- valuation gap (1)

MAFSI IS… Everywhere food is. And everywhere you are.

275 rep agencies, 260 manufacturers and 2,400 members strong. Spanning North America, feeding 300 million people and changing an industry.

Contact Us

Atlanta, GA 30307