Global M&A deals across all industries exceeded $1.0 trillion during the second quarter of 2014, the highest level since 2007, according to Thompson Reuters. Private equity groups and corporations, sitting on stockpiles of cash coupled with the ability to borrow at record low rates, are helping drive the acquisition spree. The healthcare industry appears to be riding the coattails of the overall market activity. Through the first half of 2014 the healthcare sectors tracked by the PCE Industry Update – Healthcare show that 729 M&A transaction deals were announced or closed compared to only 631 in the same period in 2013.

Merger & Acquisition Trends in the Healthcare Industry

Topics: Articles, healthcare, Hide Date, M&A

I was recently exposed to an interesting study called Roads to Resilience, which is a 2014 report by the UK’s Cranfield School of Management on behalf of the UK insurance and risk consultancy, Airmic. The basic thesis is that opportunity is the upside of risk, and that seizing risk-driven opportunities requires a decisive and rapid response, which in turn requires empowered teams, practiced processes and flexible resources.

State of the M&A Market: The Divestiture Paradox

One may anticipate a spike in corporate divestitures immediately following a period of significant economic decline as companies pull back the reigns and focus on reducing non-core / under-performing units. Similarly, one may also expect activity to decline in the years following as businesses right-size the ship and transition into a more stable market. Oddly enough, these expectations were contradicted in the years surrounding the 2008 financial crisis. Divestiture activity for the five year period prior to the crisis depicted consistent expansion with annual growth of ~ 3%, but revealed a change once the crisis set in. Activity constricted by ~ 2% between 2008 and 2009 while companies accessed what to do next, but then started on an upward trajectory with growth of nearly 7% per year thereafter through first half of 2014. In the five year period (06/09 to 06/14), divestitures increased by nearly 40% from 2,500 per year to 3,500.

Topics: Articles, Hide Date, Banking, Finance & Insurance, M&A

While it may seem at face value (pun intended) that the value of a note is equal to the outstanding principal balance; this is often not the case. The fair market value of a note is dependent on several factors, two of the most important being “counter-party risk,” which means the creditworthiness of the debtor, and cost of capital at the date of analysis. Understanding the creditworthiness of the debtor is the more complicated of the two, and potentially involves analyzing the debtor’s financial condition, and could involve a fairly complex analysis of an operating company, including an analysis of quality of assets and cash flows, the determination of a corporate credit score (Z-score), and other such analyses that are typical for underwriting debt. As an ancillary consideration, the lender should require access to relevant records so as to be able to perform such analyses if necessary.

Topics: Articles, Valuation, Hide Date, Banking, Finance & Insurance

A Prescription for M&A – Compound Pharmacies Face Change

The compounding pharmacy industry is ripe for consolidation and many anticipate a pickup in M&A activity. As compounding pharmacist head to Washington, DC to attend the industry insiders “IACP’s 20th Compounders on Capitol Hill 2014” summit later this month, it is worthwhile to provide insight on this subsector.

Topics: Articles, healthcare, Hide Date, M&A

State of the M&A Market: Private Equity’s Compounding Influence

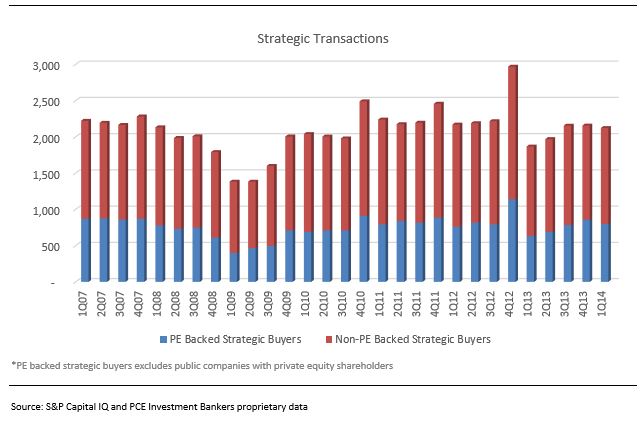

Private Equity (PE) has a strong influence on the M&A market that goes beyond the initial platform transaction (PE Platform Transactions). PE Platform Transactions have steadily represented a low percentage of the total transaction volume over the past few years. Since the beginning of 2007, PE Platform Transactions have stayed within a band of 8% to 10% of total transaction volume on a quarterly basis. This data would lead one to believe that PE’s influence on the M&A market is minimal. However, a deeper analysis shows that PE portfolio companies represent a meaningful percentage of strategic acquisitions (PE Backed Transactions).

Oil and Gas Troubles in the East Create Opportunities in the West

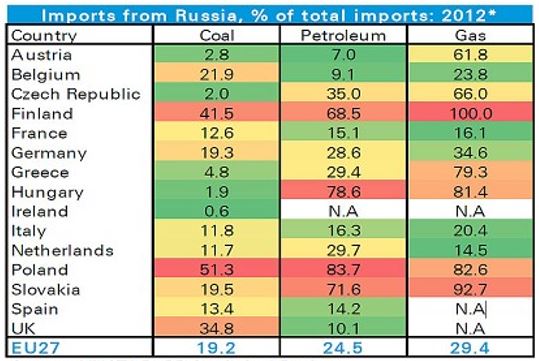

The recent events in Ukraine are likely to have significant effects on the global market for natural gas with the likely winners being non-Russian companies that fulfill the demand for this commodity. Current events have proven that Russia, whose credibility in this sector was marginal to begin with, cannot be counted on as a partner that can reliably deliver natural gas to customers. Today, Russia is the dominant provider of natural gas to many European countries, due to their abundant supply. Although there is great economic incentive for Russia to build a consistent and reliable supply chain, this natural resource has become a political weapon for the Russian government.

Topics: Articles, Power & Energy, Diversified Industrials, Hide Date, M&A

Who is in Your Corner? The Value of Hiring a True Expert

My good friend Peter Kawulia, 78, is a distinguished member of the Manitoba Sports Hall of Fame, and the third-ranked featherweight boxer in the history of the British Empire(1). In that Pete was never knocked out, and was cut only once in 115 bouts, he knows his way around the ring. If Pete were to share his thoughts he would undoubtedly say that regardless of his awe-inspiring talent, whom he had in his corner was crucial to his success. The heirs of Helen Richardson(2) recently learned the importance of this choice, as clearly they could have avoided a knockout and the resulting “medical bills” with the right professionals in their corner.

M&A Upswing for Building Products & Construction Industry

We have started to experience greater interest in the Building Products / Construction sector over the past few months. This attention is both from owners and buyers – equally strategic and private equity. Clearly the increased activity in the residential and commercial building arena has brought awareness of improving revenues and profitability.

Topics: Articles, Hide Date, Building Products & Construction, M&A

Meld je hier aan!

Recente berichten

Berichten geordend op tag

- Hide Date (199)

- Articles (175)

- M&A (101)

- Valuation (55)

- News (42)

- ESOP (29)

- Events (23)

- healthcare (17)

- Diversified Industrials (14)

- Building Products & Construction (13)

- Power & Energy (13)

- Banking, Finance & Insurance (12)

- Industry Reports (12)

- Advisory (10)

- Aerospace & Defense (9)

- E-books (7)

- IT & Telecom (6)

- Transportation & Logistics (5)

- Private Equity (4)

- PE (3)

- Uncategorized (3)

- Business Services (2)

- Case Studies (2)

- business owner (2)

- due diligence (2)

- Consumer & Food (1)

- ESOP Valuations (1)

- Tri-City Electrical (1)

- acquisition (1)

- acquisitions (1)

- category/test (1)

- construction (1)

- crane rental (1)

- cybersecurity (1)

- international (1)

- recapitalization (1)

- representations and warranties (1)

- reps and warrants (1)

- strategy (1)

- valuation gap (1)

MAFSI IS… Everywhere food is. And everywhere you are.

275 rep agencies, 260 manufacturers and 2,400 members strong. Spanning North America, feeding 300 million people and changing an industry.

Contact Us

Atlanta, GA 30307