The mergers and acquisitions markets were forced to step back and evaluate where they stood following the credit crisis in the second half of 2007. After some introspection, it appears that the market for middle market companies (value < $250 million) remains vibrant. While larger transactions (value > $250 million) suffered due to deteriorating credit markets and company performance (i.e. SLM Corp., United Rentals, Harman International, Acxiom), strategic and financial acquirers still exhibit strong appetites for quality assets. Buyers are on the lookout for companies with good product/service mixes that fill a market need and provide strong cash flow. Financial acquirers flush with cash and strategic buyers with strong balance sheets continue to seek desirable opportunities. While there has been some impact on valuations and debt levels, particularly multiples for acquisitions under $50 million, transaction levels and pricing remain lively. In addition, fears of a recession as well as the recent market correction will affect mergers and acquisitions activity, but will be partially offset by the resulting lower interest rates. Together these factors project an active market for mergers and acquisitions in 2008, although off previous highs.

Modeling, Simulation & Training: Middle Market M&A Activity in 2008 and Beyond

In the 25 June 2007 issue of the PCE Aerospace & Defense Newsletter, we presented a bullish 12-18 month outlook on the modeling, simulation & training (MS&T) sector, and per our predictions, deal activity and prices obtained by sellers have remained high. MS&T owners have continued to receive a median 1.8x sales price when selling their companies.

Topics: Aerospace & Defense, Articles, Hide Date, M&A

Considering a Liquidity Event? Value Drivers for Distribution Businesses

Ongoing M&A activity within the wholesale distribution industry has an increasing number of owner’s contemplating the sale of their business. Those who properly prepare and consider the criteria buyers use for an acquisition consistently achieve more favorable outcomes.

Topics: Articles, Diversified Industrials, Hide Date, M&A

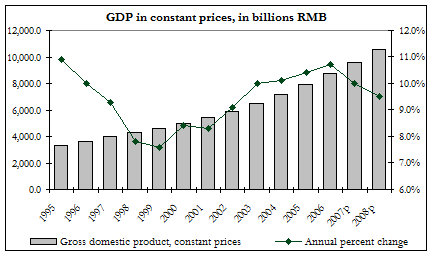

Managing the sale of a U.S. based company with worldwide operations – that included a fast growing facility in China – enabled me to learn firsthand what challenges and opportunities U.S. businesses encounter in the Far East. Middle market companies with operations in China are well positioned to receive a premium price from strategic and financial acquirers due to the vast opportunity this country represents. Most middle market companies in this segment are limited not by the prospects, but the access to capital to meet the growing demands of an ever-expanding marketplace. For American corporations, China represents an explosive growth opportunity that can have a highly accretive effect on the value of a business.

Many owners of closely held businesses realize Employee Stock Ownership Plans (ESOPs) effectively meet their liquidity and business succession needs. Through this process, they discover that ESOPs also have tremendous value as an estate planning tool, an often overlooked benefit. The benefits come in the form of reduction of estate taxes, gifting plans, accurate valuation and liquidity options.

Fairness opinions offered for business transactions generally ensure the best interests of the equity holders of a company are protected. Occasionally, at least under current criteria, consideration may also be given to creditors.

The Impact of Large Biotechnology Centers on Florida’s Economy

Florida’s commitment to forming a biotechnology cluster within the state will have significant impact on both the healthcare industry and Florida’s overall economy during the next 10 to 15 years. During the last four years, the state has earmarked nearly $700 million in incentive plans to help attract two of the largest biotechnology research institutes in the world, the Scripps Research Institute and the Burnham Institute.

Topics: Articles, healthcare, Hide Date, IT & Telecom, M&A

In the world of finance, money is more than a mere measurement of wealth – it’s almost as revered as a religion. Based on the attendance at this year’s ACG (Association of Capital Growth) National Conference, this annual gathering of the financial faithful may soon be known as the “mecca of finance.” What began three years ago with fewer than 500 attendees has exploded into an enormous event attracting nearly 2,000 finance professionals, no small feat since each attendee paid a substantial registration fee.

Topics: Articles, Hide Date, Banking, Finance & Insurance, M&A

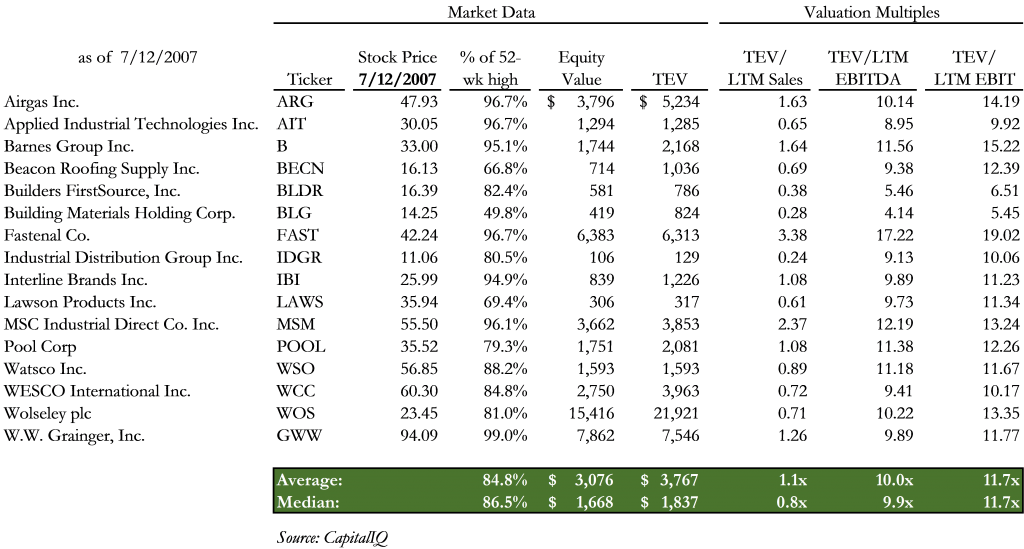

Wholesale Distribution: Valuation and M&A Activity Robust

Capital from financial institutions, strategic buyers, private equity firms and individuals continues to flow into the wholesale distribution industry. This influx has led to strong valuations for publicly traded distributors and solid transaction multiples for operators who sold businesses. In our opinion, two main fundamental drivers lead this charge – the attractiveness of the distribution industry and the current availability of capital.

Topics: Articles, Diversified Industrials, Hide Date, M&A

The dramatic reversal of the home building industry raised concerns of a far reaching domino effect in which the entire US economy weakened into recession. One contravening factor has been the strength of the non-residential construction industry, experiencing a significant surge of its own, and helping to mop up the unemployment created from the housing downturn.

Topics: Articles, Hide Date, Building Products & Construction, M&A

Meld je hier aan!

Recente berichten

Berichten geordend op tag

- Hide Date (199)

- Articles (175)

- M&A (101)

- Valuation (55)

- News (42)

- ESOP (29)

- Events (23)

- healthcare (17)

- Diversified Industrials (14)

- Building Products & Construction (13)

- Power & Energy (13)

- Banking, Finance & Insurance (12)

- Industry Reports (12)

- Advisory (10)

- Aerospace & Defense (9)

- E-books (7)

- IT & Telecom (6)

- Transportation & Logistics (5)

- Private Equity (4)

- PE (3)

- Uncategorized (3)

- Business Services (2)

- Case Studies (2)

- business owner (2)

- due diligence (2)

- Consumer & Food (1)

- ESOP Valuations (1)

- Tri-City Electrical (1)

- acquisition (1)

- acquisitions (1)

- category/test (1)

- construction (1)

- crane rental (1)

- cybersecurity (1)

- international (1)

- recapitalization (1)

- representations and warranties (1)

- reps and warrants (1)

- strategy (1)

- valuation gap (1)

MAFSI IS… Everywhere food is. And everywhere you are.

275 rep agencies, 260 manufacturers and 2,400 members strong. Spanning North America, feeding 300 million people and changing an industry.

Contact Us

Atlanta, GA 30307