PCE advised Physician Associates, LLC on its sale to Orlando Health. PCE acted as exclusive valuation and financial advisor to Physician Associates.

PCE Advises Physician Associates on Sale to Orlando Health

How do you determine the value of an undivided interest in real estate? That is the question from numerous readers of my January newsletter (here), besides their seeking insight to the case specifics I discussed. For background purposes, the IRS attempted to disqualify me as an expert in the case because I am not a real estate appraiser. The Court eventually accepted me as an expert based on my experience in valuing similar interests, rather than deciding based on the nature of the interest. I believe valuation should be done as a “security” and the IRS view is one of a “real property interest.”

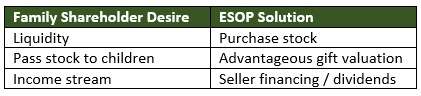

ESOPs – Keeping Family Businesses in the “Family”

Family-owned businesses, a key pillar in the American economy, make up a significant number of the privately held companies across our country. Although these companies cut across all industries and range in size from small to large, they all share common challenges. The most daunting of these challenges is how to manage the transition of the business from generation to generation. Keeping the core family values balanced with an ever-changing market place and often diverging goals amongst the family members is a challenge that many family businesses don’t survive. One intriguing solution to this challenge for many family-owned businesses is to bring the employees into the shareholder group through the sale of stock to an Employee Stock Ownership Plan (ESOP).

State of the M&A Market: “Hot Industries” an Oxymoron in 2013?

I guess it depends on how you classify “hot industries”. Hot in 2013 would be better depicted as cool with a touch of lukewarm, tepid at best. Of the ten industries defined and tracked by PCE, nine saw a drop in transaction volume during the year. The sole gainer, consumer discretionary, improved upon its 2012 volume by a mere 2.0%.

Is it the flu or a more chronic illness? As measured by pre-2010 transaction activity, deals were plentiful in 2013. However, most M&A professionals observed that 2013 ended with business owners and deal-makers on a more guarded note. The recent tepid mood shift is evident in 4th quarter 2013 M&A activity. Every sub-sector of healthcare experienced a drop in transaction volume except Equipment & Supply. See “PCE Industry Update – Healthcare 4th Quarter 2013” report.

Topics: Articles, healthcare, Hide Date, M&A

In preparing for a recent trial in US Tax Court, I was reviewing a valuation we had performed several years ago. The valuation was of a 40% undivided interest in real estate, a tenant-in-common (TIC) interest. There was no formal entity into which the real estate or the interest had been contributed.

PCE Advises Hisco on Acquisition of All-Spec Industries

Hisco, an employee-owned, specialty distribution company serving the aerospace, electronic assembly, medical device and other industrial markets, announced the acquisition of online distributor All-Spec Industries. PCE Investment Bankers originated and served as financial advisor to Hisco.

Regulators Increase Scrutiny on PEGs and Public Companies

Regulators from the Public Company Accounting Oversight Board (PCAOB) to the Securities and Exchange Commission (SEC) Enforcement Division are turning up the heat on valuations used for financial reporting of private equity groups (PEGs) and publicly traded companies. This increased focus emphasizes the importance to use qualified independent valuation specialists to ensure compliance with existing and changing requirements, along with peace-of-mind for management and investors.

Private Equity (PE) transaction activity in 2013 has experienced a shift back to its historical pattern. Over the past twenty years the PE M&A transactions, both acquisitions and exits, in the U.S. have moved in congruence with PE capital raised except for the period 2010-2012. As the amount of capital raised has increased, so have PE transactions, and as the amount of capital raised has decreased, so have PE transactions. Although there is a correlation between PE transaction activity and PE capital raised throughout the full timeframe of 1995-2013 (R2=0.407, p=0.003)1,2, there is a significantly stronger correlation when the years 2010-2012 are excluded (R2=0.836, p<0.0001) 1,2.

Lending to Heirs – Valuation of Notes Receivable for Estate Planning Purposes

In general, the idea of lending money to our children can bring mixed emotions. Just the idea of putting our dollars into their hands can cause angst. Will the kids use the money wisely? Will they repay the loan as promised? What are the impacts to our own finances? These are all valid concerns under normal circumstances – assuming the children need the money. However, there are reasons to lend to our children that have little to do with their needs. Lending to our heirs is an estate planning tool that works, and the valuation implications can be significant.

Meld je hier aan!

Recente berichten

Berichten geordend op tag

- Hide Date (199)

- Articles (175)

- M&A (101)

- Valuation (55)

- News (42)

- ESOP (29)

- Events (23)

- healthcare (17)

- Diversified Industrials (14)

- Building Products & Construction (13)

- Power & Energy (13)

- Banking, Finance & Insurance (12)

- Industry Reports (12)

- Advisory (10)

- Aerospace & Defense (9)

- E-books (7)

- IT & Telecom (6)

- Transportation & Logistics (5)

- Private Equity (4)

- PE (3)

- Uncategorized (3)

- Business Services (2)

- Case Studies (2)

- business owner (2)

- due diligence (2)

- Consumer & Food (1)

- ESOP Valuations (1)

- Tri-City Electrical (1)

- acquisition (1)

- acquisitions (1)

- category/test (1)

- construction (1)

- crane rental (1)

- cybersecurity (1)

- international (1)

- recapitalization (1)

- representations and warranties (1)

- reps and warrants (1)

- strategy (1)

- valuation gap (1)

MAFSI IS… Everywhere food is. And everywhere you are.

275 rep agencies, 260 manufacturers and 2,400 members strong. Spanning North America, feeding 300 million people and changing an industry.

Contact Us

Atlanta, GA 30307