In the merger and acquisition market there have been many flavors of the month, but the demand for industrial companies is the equivalent of chocolate: almost universally and consistently liked by acquirers. Industrial companies including, manufacturing, distribution and services, are a significant portion of the American economy and will remain so well into the future. At one time, the demise of the industrial sector was predicted as low cost manufacturing transitioned overseas. In recent years the demand for industrial products produced in the U.S. has expanded. Throughout these differing viewpoints M&A activity in the industrial sector has remained strong.

Deborah Domroski

Recent Posts

Appetite for Industrial Companies Remains Insatiable

Topics: Articles, Power & Energy, Diversified Industrials, M&A

I was recently exposed to an interesting study called Roads to Resilience, which is a 2014 report by the UK’s Cranfield School of Management on behalf of the UK insurance and risk consultancy, Airmic. The basic thesis is that opportunity is the upside of risk, and that seizing risk-driven opportunities requires a decisive and rapid response, which in turn requires empowered teams, practiced processes and flexible resources.

M&A Upswing for Building Products & Construction Industry

We have started to experience greater interest in the Building Products / Construction sector over the past few months. This attention is both from owners and buyers – equally strategic and private equity. Clearly the increased activity in the residential and commercial building arena has brought awareness of improving revenues and profitability.

Topics: Articles, Hide Date, Building Products & Construction, M&A

ESOPs – Keeping Family Businesses in the “Family”

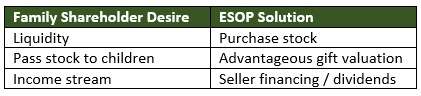

Family-owned businesses, a key pillar in the American economy, make up a significant number of the privately held companies across our country. Although these companies cut across all industries and range in size from small to large, they all share common challenges. The most daunting of these challenges is how to manage the transition of the business from generation to generation. Keeping the core family values balanced with an ever-changing market place and often diverging goals amongst the family members is a challenge that many family businesses don’t survive. One intriguing solution to this challenge for many family-owned businesses is to bring the employees into the shareholder group through the sale of stock to an Employee Stock Ownership Plan (ESOP).

Private Equity (PE) transaction activity in 2013 has experienced a shift back to its historical pattern. Over the past twenty years the PE M&A transactions, both acquisitions and exits, in the U.S. have moved in congruence with PE capital raised except for the period 2010-2012. As the amount of capital raised has increased, so have PE transactions, and as the amount of capital raised has decreased, so have PE transactions. Although there is a correlation between PE transaction activity and PE capital raised throughout the full timeframe of 1995-2013 (R2=0.407, p=0.003)1,2, there is a significantly stronger correlation when the years 2010-2012 are excluded (R2=0.836, p<0.0001) 1,2.

The supply of global energy appears to be shifting and the United States is the primary beneficiary. According to the recent International Energy Agency’s (IEA) World Energy Outlook, the world is in the process of significantly changing the countries that supply fuels as well as the types of fuels used to provide power around the world. The headline from the report states that the global energy map is changing with the primary impetus being unconventional oil and gas production in the United States. Access to unconventional sources of oil and gas has expanded production, which has led to greater resources and better fuel pricing, spurring economic activity and changing the face of global energy trade. As a result, this and related sectors should expect high levels of investment and power industry M&A activity for many years to come.

Topics: Articles, Power & Energy, Hide Date, M&A

Today is one of the most interesting times in recent history to be the owner of a privately-held business as these owners find themselves experiencing a rebound in the domestic economy but facing an uncertain tax environment. The question that many business owners are asking themselves is do we monetize some or all of our company today and capture the increased value of the business and lower tax rates or do we stay invested and realize further value appreciation but risk a higher tax environment. While the path becomes clear for many business owners, many remain in a quandary. The answer for these individuals may lie somewhere in the middle where they can monetize some of their investment in the current low tax rate environment, keep significant ownership for future appreciation and reduce their corporate and individual tax profiles. These are all achievable goals by executing a sale of a portion of their company to an Employee Stock Ownership Plan (ESOP).

Analysis of the American Recovery and Reinvestment Act of 2009

Topics: Articles, Power & Energy, Transportation & Logistics, Hide Date, Building Products & Construction, M&A

Keys to Understanding Your Company’s Value Drivers

As an owner of a privately held business, you have significant personal wealth already invested in your company. When reviewing the annual returns your business delivers, it’s easy to calculate returns based on the book value of the company. For example, book value of $4 million and pre-tax earnings of $1 million generates an attractive 25% return. However, you certainly wouldn’t sell your company for book value, so the returns on the “investment” you have in your private business should be based on market value. (Market value of $20 million with the same $1 million of earnings generates a less impressive 5% return.)

Meld je hier aan!

Recente berichten

Berichten geordend op tag

- Hide Date (199)

- Articles (175)

- M&A (101)

- Valuation (55)

- News (42)

- ESOP (29)

- Events (23)

- healthcare (17)

- Diversified Industrials (14)

- Building Products & Construction (13)

- Power & Energy (13)

- Banking, Finance & Insurance (12)

- Industry Reports (12)

- Advisory (10)

- Aerospace & Defense (9)

- E-books (7)

- IT & Telecom (6)

- Transportation & Logistics (5)

- Private Equity (4)

- PE (3)

- Uncategorized (3)

- Business Services (2)

- Case Studies (2)

- business owner (2)

- due diligence (2)

- Consumer & Food (1)

- ESOP Valuations (1)

- Tri-City Electrical (1)

- acquisition (1)

- acquisitions (1)

- category/test (1)

- construction (1)

- crane rental (1)

- cybersecurity (1)

- international (1)

- recapitalization (1)

- representations and warranties (1)

- reps and warrants (1)

- strategy (1)

- valuation gap (1)

MAFSI IS… Everywhere food is. And everywhere you are.

275 rep agencies, 260 manufacturers and 2,400 members strong. Spanning North America, feeding 300 million people and changing an industry.

Contact Us

Atlanta, GA 30307